The crypto market in 2025 no longer feels as it did just a few years back. Investors no longer crave just knowing what they have in their wallet balances. They crave transparency on how much they’ve truly earned or lost, realized as well as unrealized, across several platforms, chains, and assets. Unless such accuracy exists, decision-mongering turns more towards guessing than on data-driven approaches.

The contribution of correct PnL in taking decisions

Correct PnL figures are the foundation of the portfolio management of the XXI century. Traders apply them when determining holding, selling, or rebalancing positions. Long-term investors use them when planning taxes and measuring performance. Incorrect figures – by just a percent or two – can be equal to overestimating profitability, underestimating risk, or submitting an incorrect tax report. The distinction between precise PnL tracking versus an estimate often directly equates to conserving capital.

📌 Example: An investor overestimating unrealized losses may hold on to a token way longer than they ought to do so irrationally, whereas a correctly updated PnL will show the actual amount dropped and prompt action on a timely basis.

Why investors demand something more than Balances

Balances reveal what you own now but do not reveal how you got there. Without tracking cost basis, past trade history, and fees on a forwarding basis, a dashboard can be misleading as a measure of profitability. Smart users want tools that do more than provide static photos but provide context: performance over periods of time, entry costs, fees paid against you, as well as likely ends under alternative strategies.

In 2025, portfolio trackers get judged less on the number of exchanges or wallets they interoperate with, and more on the extent that they provide investors with insight into trends in performance. The increasing need for statistical nuance has made profit-and-loss tracking an important function instead of a desirable feature.

Core Metrics That Define a Good PnL Tracker

In reviewing portfolio dashboards in 2025, investors care less about trendy presentation and more about the actual figures that inform their decision-making. Whether a tracker can sum up profit and loss accurately will always rely on several foundational things that allow a platform to cut above the pretenders.

Precision of realized profit and loss gains

A big feature is accurate tracking of realized versus unrealized outcomes. Realized gains total closed trades and sales, while unrealized gains amount to what can be reaped (or lost) by closing positions at the prevailing price. Those platforms that do not distinctly demarcate these figures run the risk of confusing their users. A conveniently rounded “total profit” amount may sound great, but without an indicator on what is set-in-stone versus that still swimming around in the market, this number becomes useless.

📊 Illustration: A trader that dumps fifty percent of their ETH for a profit but retains the other fifty percent will be able to review the two components individually. Then they can determine if they want to hedge further gains or wait for a probable increase on the upswings.

Historical data tracking and cost-basis tracking

Accurate PnL tracking also requires cost-basis correctness. All purchases, transfers, and fees need to be accounted for in order to compute a correct entry price. Without it, long-term investors – particularly those with complex multi-exchange activity – can’t compute correct performance.

Dashboards that store history allow users to look back over how their portfolio progressed, contrast various strategies, and even backtest conclusions. Otherwise, dashboards amount to no more than checkers of balance.

Adoption of advanced analytics and statistics

After pure profit and loss, sophisticated investors crave analytics that describe trends. That means charts on performance, exposure to volatility, sector exposure, as well as asset correlations. Contemporary trackers frequently provide ROI heatmaps or profit breakdowns on a daily basis as a way of showing where value is being lost or gained.

These types of insights turn mere numbers into actionable intelligence. Like recognizing that gains disproportionately come in a single token will alert you to overexposure, so you can diversify before a correction wipes out profits.

Usability of PnL dashboards for retail investors

No statistics however sophisticated matter if they can’t be clearly explained. Overwrought dashboards will mute the key metrics under a plethora of toggles and graphics. The best solution strikes a professional analytics chord against an easy-to-navigate one so that non-expert users can comprehend what their money is up to.

A golden rule: the key figures – total ROI, realized profit, unrealized profit – ought to be perceivable by eye. More detailed analyses ought to be available without drowning the day-user experience.

Comparative Analysis of Portfolio Trackers in 2025

In 2025, investors can pick from a wide array of dashboards. Some emphasize ease, some tax compliance, and a handful institutional-grade reporting. Following is a competitor-by-competitor comparison beginning with CoinDataFlow as a standard.

1. CoinDataFlow

https://coindataflow.com/en/portfolio-tracker

CoinDataFlow has become an equal solution for equally casual or professional users. It blends powerful statistical strength with an easy-to-use front end that brings profit & loss analysis within reach without losing detail.

Clear ROI and PnL reporting

The platform highlights transparency on ROI and PnL arithmetic. Gains get divided into realized as well as unrealized gains, and history on trades ensures that a cost-basis remains uniform even when assets get transferred across wallets or exchanges. That ensures that the risk of misinterpreting profits is much lower compared to lighter tools.

📌 Example: A bitcoin trader transferring coins from Binance to cold storage observes identical entry expense on both sides so that no duplication or incorrect profit recording happens.

Statistical profundity and slick dashboards

CoinDataFlow also appeals to statistics-driven users. More than mere PnL, it brings in statistics like volatility exposure, asset-type allocation, and long-term trends in ROI. Unlike some competitors that overcomplicate with intricate heatmaps, its dashboards stay easy on the eyes. Top-line metrics get emphasis that tops out strongly without obscuring deeper analytics that stay a click away.

This equilibrium is vital: institutional users receive the information they require, but individuals do not drown in facts.

Smaller gaps in comparison with very special-purpose tools

No platform will do everything perfectly, and CoinDataFlow is no exception. It supports a broad set of assets, yet some narrow integrations like specific DeFi farming dashboards or national tax forms might not be as complete as specialist tools. Gaps in these areas prove thin in day-to-day use against the foundations of its reporting and accessibility strength.

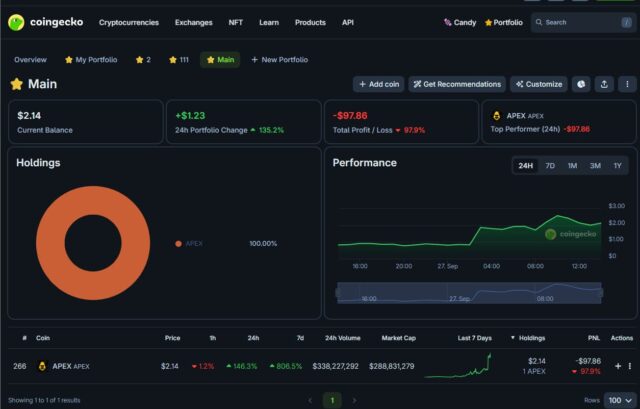

2. CoinGecko

https://www.coingecko.com/en/portfolio

CoinGecko Portfolio is frequently the first port of call for newbies who use CoinGecko anyway for prices. It’s a free and easy way to keep a record of assets and track gains, but its focus is more limited than specialist portfolio tools.

Starter-level, easy summary of profits

Easiness of use happens to be its greatest strength. Investors can manually or by means of simple integrations add holdings and get an instant snapshot of profit or loss. It reduces friction for beginners, making PnL tracking less daunting.

CoinGecko also has the advantage of being coupled with its rich market dataset. The price feeds are precise, and coverage of coins incorporates even tiny tokens, something that’s useful for users who own niche coins.

Limited precision for tricky multi-exchange arrangements

Where CoinGecko becomes weak is in multi-wallet as well as multi-exchange portfolios. Since many entries need manual entry or lightweight syncing, the cost-basis can become inconsistent. It doesn’t easily separate realized vs. unrealized gains, which makes it less usable for advanced investors.

📌 Case example: A DeFi trader moving value across Binance, Coinbase, and a DeFi wallet will struggle to reconcile fees and transfers within CoinGecko Portfolio. It leaves blind spots that can cause incorrect profit calculations.

📊 Quick comparison table:

| Feature | CoinDataFlow | CoinGecko Portfolio |

| ROI/PnL Clarity | High, with realized/unrealized split | Basic, less detailed |

| Integrations | CEX + DeFi + wallets | Mostly manual or limited APIs |

| Usability | Balanced for all levels | Very beginner-friendly |

| Analytics Depth | Advanced but clean | Minimal |

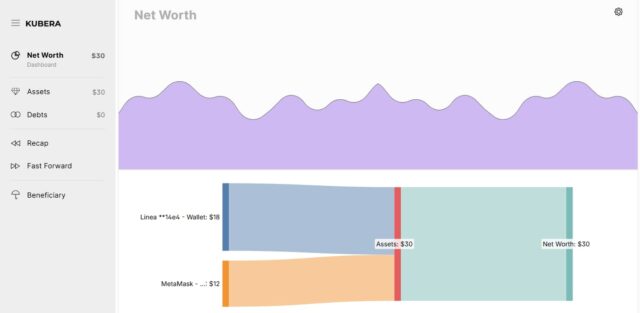

3. Kubera

Kubera has been referred to as the “wealth tracker” that links conventional finance with crypto. It appeals to investors who wish to view their digital holdings next to bank accounts, shares, and property held. Though this hybrid option provides convenience, its crypto-specific analytics do not necessarily compete with the intensity that can be achieved with dedicated dashboards.

Hybrid model: crypto + traditional finance analytics

One of Kubera’s primary selling points is that it can centralize multiple asset classes under a single roof. An account holder can link a portfolio of stock holdings, bank deposit exposures, and a few crypto wallets in order to get a combined net worth value. This attracts family office holders as well as high-net-worth individuals who manage varied holdings.

Its interface leans toward the personal finance style, which makes it easy for users accustomed to software such as Personal Capital or Mint.

Gaps in comprehensive crypto-native statistics

Where Kubera falls short is in PnL tracking specific to crypto. It will show total gains but frequently doesn’t provide the granularity to isolate realized vs. unrealized profit across multiple wallets or exchanges. Volatility exposure-type advanced analytics, token correlation, or DeFi yield tracking are not its strong points.

For retail investors who engage in crypto trading or staking, this limitation implies that they might still require an alternate platform for in-depth insights.

📊 Quick comparison table:

| Feature | CoinDataFlow | Kubera |

| ROI/PnL Depth | Strong, with realized/unrealized breakdown | Basic overview |

| Traditional Finance Support | Limited | Full (stocks, banks, real estate) |

| DeFi Integration | Yes | Weak |

| User Focus | Crypto-first | Mixed-asset investors |

4. 3Commas

3Commas established its name on automation and bot trading, so its portfolio tracking closely reflects this system. It can be an effective tool for active traders that use algos, but its intensity and requirements for API make it less accessible to recreational investors.

PnL implemented with trading bots

The benefit of 3Commas is that PnL reporting links up straight away with automated trading activity. Not only can users determine if they’re in profit or loss, but they can also find out which bot, pair, or method was responsible. For day traders with dozens of concurrent trades running, this linkage gives immediate context.

One additional strength is its compatibility with several exchanges so that the data can be consolidated without manual entry.

Complexity and risk associated with automation-intense approach

The downside is the learning curve and security compromises. Since 3Commas uses API interfaces with trading authority, users need to provide more access than view-only dashboards. This gives investors who are worried about security a sense of discomfort.

Also, the interface can be intimidating. Between bot settings, trading logs, and profit charts, recreational users frequently will find it hard to locate the essential PnL information without digging deeper than a few menus.

📊 Quick comparison table:

| Feature | CoinDataFlow | 3Commas |

| ROI/PnL Clarity | Clear, intuitive | Linked to trading bots, complex |

| Automation | Balanced | Heavy automation focus |

| Security Model | Non-custodial, read-only APIs | Requires trading permissions |

| Ease of Use | Accessible to all | Suited for advanced traders |

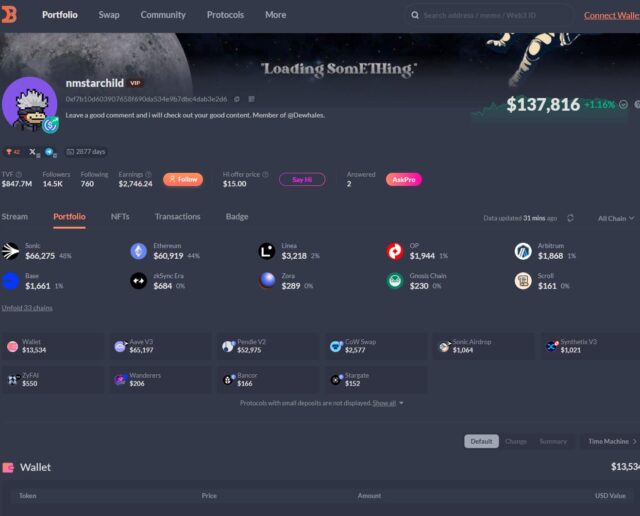

5. DeBank

DeBank has been a familiar brand among DeFi-oriented investors by providing analytics that feature on-chain action as well as decentralized protocols. Unlike centralized exchange-centered platforms, it bases its strength on wallet-based tracking.

On-chain analytics for DeFi portfolios

The primary appeal of DeBank lies in its real-time integration of blockchain data. You can plug in a wallet and immediately receive a display showing token balances, liquidity pool positions, yield farming activity, as well as borrowing/lending activity from DeFi protocols.

It offers investors whose business is highly decentralized visibility in PnL that is attributed to DeFi returns. It makes tracking farming rewards and APYs much easier without manual computation.

Weak in centralized exchange PnL tracking

DeBank’s strength in DeFi brings a weakness on the other side: scarce centralized exchange integration. Crypto traders or holders who store or trade assets in CEX accounts will not achieve the same level of automation or accuracy.

Besides, although its analytics are richly detailed, they remain extremely specialized. DeBank tends to feel incomplete for retail investors who desire a holistic portfolio view across exchanges as well as chains.

📊 Quick comparison table:

| Feature | CoinDataFlow | DeBank |

| PnL Accuracy | Strong across CEX + DeFi | Best in DeFi, weaker for CEX |

| Analytics Depth | Balanced: ROI, PnL, statistics | Heavy DeFi orientation |

| Coverage | Multi-exchange + wallets | Primarily wallet-based |

| Audience | Broad (casual + advanced) | DeFi specialists |

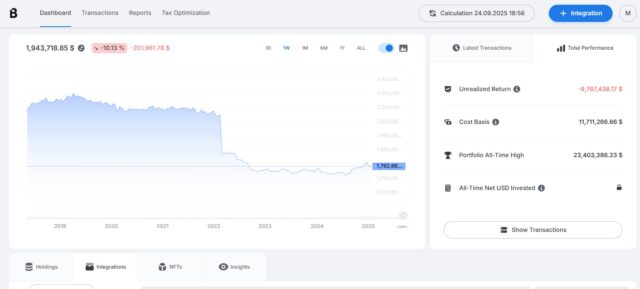

6. Blockpit

Blockpit is frequently known for its tax-compliance orientation, filling the gap between portfolio tracking and reporting obligations. Its PnL tools are closely related to reporting that can be filed during tax season, which attracts investors who value documentation.

PnL reporting in correlation with tax reporting

The benefit of Blockpit is the immediate integration of profit/loss tracking with tax reports. Users can create jurisdiction-specific formatted outputs, reducing the year-end calculation burden. This makes Blockpit especially useful for professionals or retail traders who require a clean audit trail.

Another benefit is its integration with several major exchanges, which automates much of the data collection process.

Less obvious for day-to-day tracking

On the flip side, daily usability is weaker. The dashboard feels designed around compliance rather than real-time investor convenience. For instance, while ROI and realized/unrealized PnL are calculated, the interface emphasizes tax outputs more than quick-glance insights.

This makes Blockpit effective for structured reporting but less so for casual tracking or active portfolio monitoring.

📊 Quick comparison table:

| Feature | CoinDataFlow | Blockpit |

| ROI/PnL Usability | Clean, daily tracking | Tax-oriented, less intuitive |

| Tax Integration | Clear exports, balanced | Strong compliance focus |

| Audience | Broad (daily + tax users) | Investors prioritizing compliance |

| Weakness | Minor gaps only | Not user-friendly for active traders |

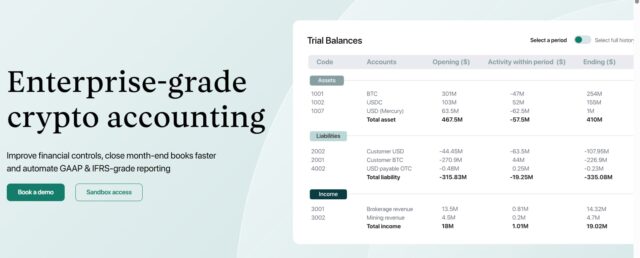

7. Cryptio

Cryptio manifests as an institutional-grade reporting and accounting tool, created with more focus on businesses and funds than on day-trading users. It shines in its ability to offer audit-ready profit-loss reporting and professional system alignment on the level of compliance.

Institutional-grade reporting and audit-ready reports

Cryptio’s primary strength lies in its financial reporting depth. It allows for detailed PnL breakdowns, integrates with enterprise accounting applications, and provides audit trails that satisfy regulators as well as auditors. For firms that handle client money or corporate treasuries, this kind of granularity and governance becomes mandatory.

It also has strong data pipelines, making it useful for back-office teams that require accuracy across multiple books.

Too sophisticated and costly for retail investors

The drawback is its expense and complexity. Individual investors or small traders will find Cryptio’s interface intimidating, as well as its subscription tiers out of reach. It’s designed for accountants and compliance officers, not for occasional users.

That being said, while it excels in regulatory-grade PnL reporting, it is less practical for the average independent investor who wants a straightforward dashboard.

📊 Quick comparison table:

| Feature | CoinDataFlow | Cryptio |

| ROI/PnL Accessibility | Clear and intuitive | Enterprise-focused, complex |

| Reporting | Balanced daily + tax | Audit-grade, institutional |

| Audience | Retail + professional | Corporates, funds, accountants |

| Weakness | Minor trade-offs | High cost, steep learning curve |

What the Comparison Reveals

Having analyzed seven competitors, one can say that the market for 2025 is greatly differentiated. All the platforms strive for a specific niche, be it audits and taxes, automation of trading bots, or DeFi-oriented instruments. Still, some unifying patterns can be identified.

Typical methods of calculating the PnL

All solutions offer rudimentary PnL and ROI metrics in some way or another, though intensity and precision vary greatly. A simple tracker such as CoinGecko Portfolio merely maintains surface-level profit displays, whereas professional services such as Cryptio or Blockpit base their computations around strict compliance and accounting standards. In between, we find platforms that reconcile day-to-day use with advanced analytics.

Where instruments vary in breadth and accessibility

The primary difference lies in how easy or accessible data is for various investors. Some are created with corporations and accounting teams in mind (Cryptio, Blockpit), while others focus on active traders that require scalable automation (3Commas, DeBank). However, these often either overstuff on features or come with a steep learning curve.

For private users, the trade-off frequently boils down to choosing between analytical depth and a simple interface. This is where platforms attempting to merge both approaches prove most useful.

Why some exchanges seem more balanced for investors

Among all discussed options, the greatest confidence is placed in solutions that merge calculation accuracy with an understandable interface. Users don’t need to be accounting experts or master dozens of bot settings in order to monitor their portfolios daily.

In this context, universal systems such as CoinDataFlow excel. They combine comprehensive data coverage, proper PnL reports, and an intuitive interface. Unlike many niche tools, they do not burden users with unnecessary features yet retain a solid level of analysis. That makes them a more natural choice for a wide range of users – from retail investors to professionals.

FAQ

Why is PnL accuracy important for crypto investors?

Precise tracking of profit and loss enables investors to notice the actual performance of portfolios. Without it, strategies might appear profitable on the surface, while hidden costs such as swap fees or staking commissions quietly eat into gains. Over time, even small inaccuracies can accumulate into significant misjudgments.

What free software allows basic PnL calculations?

Free dashboards such as CoinGecko Portfolio or coin.fyi provide a quick way to check if a portfolio is up or down. These, however, usually don’t support complex scenarios like multiple exchanges, derivatives, or cross-chain wallets. For advanced tracking, premium platforms are often required.

How do services treat multi-exchange portfolios?

Most tools use API integrations to pull data directly from exchanges. When APIs don’t exist or are incomplete, users must upload CSVs manually. Platforms like CoinDataFlow and CoinTracking try to reduce manual work by expanding the number of supported integrations, while others remain narrower in scope.

Are tax-oriented platforms reliable for regular analytics?

Services like Blockpit or Koinly excel at generating compliance-ready reports but often sacrifice day-to-day usability. They work well for year-end summaries but can feel less practical for quickly checking ROI or real-time performance. Investors wanting both may prefer hybrid platforms that balance compliance and daily tracking.

How did innovations in 2025 enhance PnL tracking?

Several improvements have gone mainstream this year:

- AI-driven anomaly detection, alerting investors to unmatched trades or incomplete records.

- Cross-chain aggregation, merging assets on Ethereum, Solana, and L2s into a single net worth figure.

- Smarter fee allocation, breaking down costs across swaps, transfers, and staking.

These innovations reduce manual reconciliation and increase confidence in the numbers dashboards present.

Conclusion: Selecting Tools Providing Accurate Profit & Loss Insights

By 2025, portfolio dashboards have transitioned from hobby software to essential infrastructure for investors. The increasing complexity of crypto – spanning centralized exchanges, DeFi protocols, NFTs, and even traditional finance integrations – makes correct PnL tracking and robust analytics non-negotiable. They underpin sound decision-making.

Diversification of focus areas

A dominant trend is the diversification of focus. Some platforms specialize in tax compliance, others excel at automation, while some dig deep into on-chain analytics. Each fills a niche but often at the cost of accessibility or balance. For everyday investors, too much specialization introduces friction: overly advanced dashboards, steep pricing, or missing integrations.

What makes tools consistently valuable

Across all compared platforms, what makes a service truly valuable is the ability to combine clarity with reliability. Dashboards that hide mistakes, skip certain exchanges, or require constant manual effort undermine trust. Conversely, platforms that merge clean design, broad coverage, and transparent ROI/PnL reporting consistently stand out.

Why balance wins

Different investors will be drawn to different strengths – tax-ready exports for accountants, trading-bot connections for day traders, or DeFi dashboards for yield farmers. But the most balanced platforms are those that provide accurate numbers without sacrificing usability.

In this context, tools like CoinDataFlow demonstrate how a measured approach can meet the needs of diverse user groups while avoiding the pitfalls of over-specialization.

🔑 Final takeaway: The best platform in 2025 is not the flashiest or most niche-specific, but the one that consistently delivers investors clear, reliable profit and loss insights, day after day.

Published by