Politics has hijacked economic direction. In this bold exposé, I uncover how power — not policy — is now steering the future.

Global Economy 2025: A Political Recalibration

In the past, economists and business leaders waited for official policy to steer strategy — regulations, tax codes, and trade deals. But in today’s landscape, those who wait lose. The real momentum comes not from passed laws, but from political shifts in real time.

In mid-2024, mere talk of a U.S.–China tariff pause sent tech giants like Apple, Nvidia, and AMD soaring — adding over $800 billion in market cap in a single day. No policy had changed. No tariffs had been lifted. Yet the market responded instantly to political signaling, not substance.

Markets react to elections, diplomatic tensions, and even the tone of a world leader’s speech. Understanding the political climate is now more predictive than tracking policy updates in 2025.

Signals Over Statutes: Fast-Moving Markets

Take a look at the way markets respond to mere headlines. When a major economy hints at restrictions on AI exports or when a leader makes comments about nationalizing tech infrastructure, the stock market doesn’t wait. Neither do venture capitalists — or app developers who depend on cloud services, APIs, or global app store access.

The message is clear: in a hyperconnected economy, signals matter more than statutes. Formal legislation takes months or years to pass. But political signals — whether from Twitter, a press conference, or leaked memos — can move billions in minutes.

How Political Signals Hit the Middle Class

For most people, the idea of markets moving $800 billion in a day feels distant. But here’s how it actually affects your wallet, job, and daily costs:

1. Prices of Electronics Can Rise or Drop Overnight

When tech stocks surge after a political signal (like a possible U.S.–China tariff pause), it’s not just a stock market story — it’s about real products. If tariffs go up, the cost of imported chips rises. Your next iPhone, laptop, or smart TV could cost $50–$200 more, even if nothing in the hardware changed. In 2024, even the rumor of tariffs caused companies to front-load shipments and tweak prices early — before any law changed.

2. Groceries and Essentials Are Impacted Too

Political shifts don’t just hit tech — they ripple into trade, fuel, and food. In 2025, the “Liberation Day” tariff threat triggered a jump in oil prices. That alone added $5–$15 more per gas tank and raised food transportation costs. Even without policy being passed, middle-class households felt the pinch in grocery receipts within a week.

3. Job Stability and Wages Can Get Shaky

Companies make hiring and investment decisions based on political tone. If a government signals a crackdown on AI or data exports, startups freeze hiring, and tech jobs get riskier — long before anything is signed into law. In 2024, uncertainty around the U.S.–China chip policy led several semiconductor companies to pause hiring or cut freelance budgets.

4. Your Retirement or Investments React Instantly

If you have a 401(k), a retirement fund, or even a small stock account, these political shifts affect your future directly.

In 2024, when markets rallied on U.S.–China tariff pause news, S&P 500–linked retirement funds gained an average of 3% in a single day. That’s hundreds or even thousands of dollars added back into middle-class portfolios — just from a signal, not a law.

As you can see, politics, not policy, now drives those everyday changes — and for middle-class families, that’s the economy we actually live in.

What We Can Do About It

First, we need to shift how we think about economic change. For a long time, we’ve assumed that laws and policies are the main levers that move markets. That’s no longer the case. Today, political signals — a speech, a tweet, a diplomatic visit — often carry more weight than legislation. So the first step is awareness.

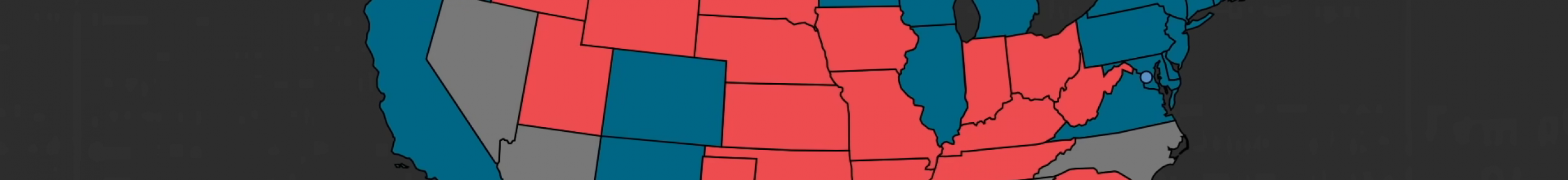

If you’re managing a business, investing for retirement, or just trying to make sense of rising prices, it helps to read the political landscape more actively. That means following not just what gets passed, but what’s being discussed, floated, or even hinted at — especially by leaders in Washington, Beijing, and Brussels.

From a practical standpoint, diversification is more important than ever. Political volatility can hit certain industries hard and fast. So whether it’s your stock portfolio or your business supply chain, building in some flexibility is wise.

Finally, we shouldn’t underestimate the importance of stable, predictable governance. Part of the solution lies in pushing for leadership that values long-term policy over short-term headlines. That’s something citizens can demand — through elections, through conversation, and through holding decision-makers accountable.

We can’t stop political influence on markets — but we can get smarter about how we respond to it.

Published by