Trump’s Impact on the Stock Market

The stock market has always been sensitive to U.S. presidents, but few leaders have left as dramatic an imprint as Donald J. Trump. From record-breaking rallies to sudden market drops triggered by tweets, Trump’s time in office reshaped how investors view political leadership and economic stability. His presidency highlighted just how tightly Wall Street is tied to Washington’s policy decisions and global diplomacy.

Trump’s economic agenda, focused on “America First,” tax reforms, and deregulation, fueled optimism in some sectors while sparking uncertainty in others. Whether you’re a retail trader, a corporate investor, or simply curious about how politics drives markets, exploring Trump’s impact offers valuable insights into today’s financial world.

Trump’s Economic Vision and Market Sentiment

Trump’s hallmark policy was “America First,” which placed heavy emphasis on reshoring jobs, imposing tariffs, and renegotiating trade deals. While these moves aimed to protect U.S. industries, they rattled global markets, especially during the U.S.–China trade war. Stock prices swung wildly whenever new tariffs or retaliatory measures were announced, demonstrating how fragile investor sentiment can be under political tension.

Deregulation and Its Immediate Stock Market Reactions

One of Trump’s strongest appeals to Wall Street was his commitment to deregulation. By rolling back financial, energy, and environmental restrictions, Trump positioned businesses to grow with fewer compliance costs. This policy shift boosted investor confidence, especially in industries like banking and fossil fuels, which saw their stocks climb.

Tax Cuts and Jobs Act: Boosting Corporate Profits

Perhaps the most impactful economic decision was the 2017 Tax Cuts and Jobs Act (TCJA). By slashing the corporate tax rate from 35% to 21%, Trump gave a massive earnings boost to U.S. companies. Stock buybacks soared, dividends increased, and the Dow Jones and S&P 500 hit record highs in the following months.

Stock Market Performance During Trump’s Presidency

Under Trump, the market saw one of the longest bull runs in history. The Dow Jones surged past 25,000 points, and unemployment hit record lows. Optimism over lower taxes and fewer regulations created a climate where corporations thrived, and investors piled into stocks.

Market Volatility Amid Trade Conflicts with China

However, this optimism was frequently tested. The U.S.–China trade war created unprecedented volatility. A single Trump tweet about tariffs could wipe billions off the market’s value within hours. Despite this, the overall upward trend remained intact, showing the resilience of the U.S. economy.

COVID-19 Crash and the Historic Recovery

In early 2020, the COVID-19 pandemic triggered a historic crash, with markets falling more than 30% in just weeks. Yet, massive government stimulus packages, combined with Trump’s pressure on the Federal Reserve to cut rates, fueled a record-breaking recovery. By the end of 2020, stock indices were reaching new highs again.

Sector-Wise Impact of Trump’s Policies

Despite regulatory uncertainty, tech giants like Apple, Amazon, and Microsoft thrived during Trump’s presidency. Lower taxes and accelerated digital adoption boosted valuations across Silicon Valley.

Manufacturing and Industrial Stocks

Manufacturers benefitted from tariff protections but faced higher costs from supply chain disruptions. While steel and aluminum companies gained, industries dependent on imports, such as automakers, experienced challenges.

Oil, Gas, and Energy Companies

Trump’s push for energy independence favored oil, gas, and coal companies. Deregulation and expanded drilling rights lifted the energy sector, though volatile oil prices limited long-term gains.

Healthcare and Pharmaceutical Industry

Healthcare stocks experienced mixed results. While pharmaceutical giants benefitted from deregulation, uncertainty over drug pricing reforms kept investors cautious.

Trump’s Tweets and Market Volatility

Donald Trump was the first U.S. president to use Twitter as a direct economic weapon. His posts often sent shockwaves through Wall Street, creating what analysts called “tweet risk.” A single message about tariffs, the Federal Reserve, or relations with China could trigger massive fluctuations in stock indices. For example, in August 2019, a series of tweets about escalating tariffs with China caused the Dow Jones to drop over 600 points in one day.

Investor Reactions to Political Uncertainty

Investors typically prefer stability, yet Trump’s unpredictability kept markets on edge. Short-term traders thrived on the volatility, while long-term investors had to balance gains from tax reforms and deregulation against risks from erratic policy announcements. This demonstrated how modern communication platforms can amplify political and financial uncertainty.

Comparison: Trump’s Market vs. Previous Presidents

Obama inherited a financial crisis in 2009 and oversaw one of the longest bull markets in U.S. history. Trump, however, entered office during already strong growth and accelerated it with tax cuts. While Obama’s gains were steadier, Trump’s market was marked by sharper swings but stronger short-term surges.

Trump vs. Biden’s Stock Market Performance

Under President Joe Biden, markets continued to grow, though at a different pace. Biden’s policies have focused on green energy, infrastructure spending, and regulating big tech, contrasting with Trump’s deregulatory approach. While both presidencies saw record highs, Trump’s market leaned more heavily on corporate tax relief and deregulation, whereas Biden’s growth has been supported by post-pandemic recovery spending.

Global Market Repercussions of Trump’s Policies

Trump’s tariffs on European steel and aluminum, along with threats against NATO allies over trade imbalances, caused European stock indices to dip during key announcements. German automakers, in particular, faced heavy scrutiny, sparking investor unease across the EU.

Asian Stock Markets and Trade Tensions

The U.S.–China trade war had profound effects on Asian markets. Chinese stocks, along with emerging markets in Southeast Asia, saw significant capital outflows as investors feared long-term decoupling between the world’s two largest economies. At the same time, some countries like Vietnam and India benefitted, as companies sought alternatives to China for manufacturing.

Long-Term Lessons from Trump’s Market Influence

One clear takeaway from Trump’s presidency is that political actions can shape markets as much as economic fundamentals. Investors learned to factor in geopolitical risk, trade disputes, and policy unpredictability as much as corporate earnings.

The Rise of Retail Investors During Trump’s Era

Another major trend was the rise of retail trading platforms like Robinhood, which exploded in popularity during Trump’s presidency. Social media-driven investing, combined with stimulus checks during the pandemic, fueled a new generation of retail investors who now play a more significant role in market movements.

Predictions: How Trump Could Influence Future Markets

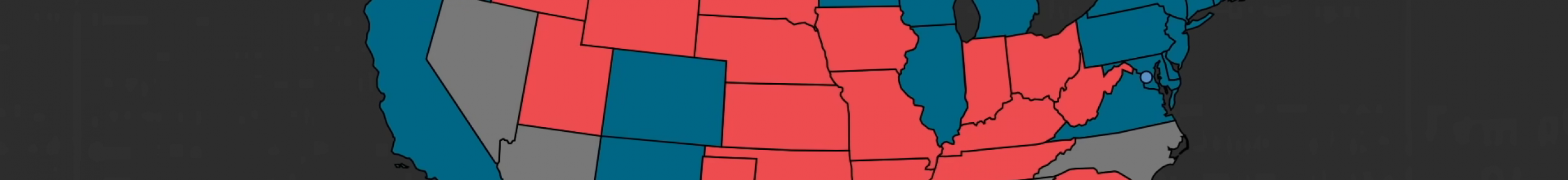

If Trump were to return to office, analysts predict he might double down on tariff-driven trade policies, further deregulation, and tax incentives. This could benefit energy, defense, and manufacturing sectors, but risks reigniting trade conflicts and global market volatility.

Risks and Opportunities for Global Investors

Global investors should prepare for both short-term volatility and long-term structural shifts. Opportunities may arise in industries Trump favors, but uncertainty in international trade could create challenges for multinational corporations and foreign investors.

Frequently Asked Questions (FAQs)

1. Did the stock market perform well during Trump’s presidency?

Yes, the market reached record highs during Trump’s presidency, largely driven by corporate tax cuts and deregulation. However, it also faced extreme volatility, especially during trade wars and the COVID-19 pandemic.

2. How did Trump’s tweets affect the stock market?

Trump’s tweets often moved markets significantly, especially when addressing trade negotiations, tariffs, or Federal Reserve policy. Investors closely monitored his social media for signs of policy direction.

3. Which sectors benefited most from Trump’s policies?

Energy, banking, and defense industries saw significant benefits due to deregulation and increased government spending. Technology also thrived thanks to lower taxes and rising demand.

4. How did Trump’s market compare to Obama’s?

Obama oversaw a steady recovery from the 2008 crisis, while Trump accelerated growth through tax reforms. However, Trump’s market was more volatile, with sharper ups and downs.

5. What global effects did Trump’s policies have on markets?

Trump’s trade wars, especially with China, disrupted global supply chains and caused uncertainty in Asian and European markets. Some countries gained as businesses sought alternatives to China.

6. Could Trump’s return impact markets in the future?

Yes, a return could bring renewed volatility. Potential policies like renewed tariffs, deregulation, and tax incentives might boost certain industries but also increase global tensions.

Understanding Trump’s Stock Market Legacy

Donald Trump’s presidency was a defining era for Wall Street. His tax reforms, deregulation, and pro-business stance created one of the strongest stock rallies in modern history. At the same time, his unpredictability, trade wars, and Twitter diplomacy introduced a level of volatility rarely seen before.

For investors, the Trump era serves as a reminder that markets are not only driven by earnings and data but also by political leadership, global diplomacy, and public sentiment. Whether one views his impact as positive or disruptive, one fact remains clear: Trump forever changed the way politics and the stock market interact.